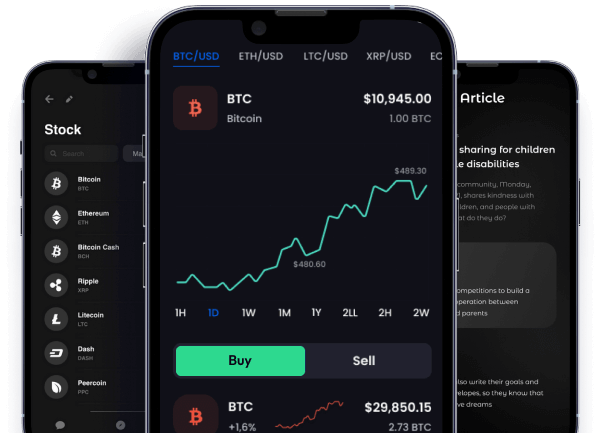

$SRD will be listed on Raydium DEX after launch, with plans for centralized exchange (CEX) listings in future phases.

SOLCRED allows users to borrow SOL or stablecoins (USDT, USDC) using any token as collateral. Lenders can deposit funds to earn 1% daily interest (365% APY). AI ensures all collateral tokens meet security and liquidity standards.